What is the ABLE (Achieving a Better Life Experience) Act?

“In December 2014, the Achieving a Better Life Experience (ABLE) Act was signed into law by Congress authorizing individuals with disabilities to open tax-exempt savings accounts to save for disability-related expenses without impacting eligibility for resource-based benefits. The act permits individuals with disabilities to save more than a total of $2,000 in assets (cash, savings, etc.) in their name in a qualified ABLE account. The passage of this federal law was a grassroots movement of parents and disability organizations across the nation so that savings accounts could be opened for those with disabilities.” (Source: ENABLE website)

After the federal law was passed, each individual state also had to pass the ABLE act. Nebraska passed the ABLE Act in 2015. Legislative action was needed at both a federal and state level due to the act’s effect on tax codes.

The ABLE National Resource Center in Washington, D.C., has both a video and a written explanation about what ABLE account are and 10 Things That You Should Know.

What is the ENABLE Savings Plan?

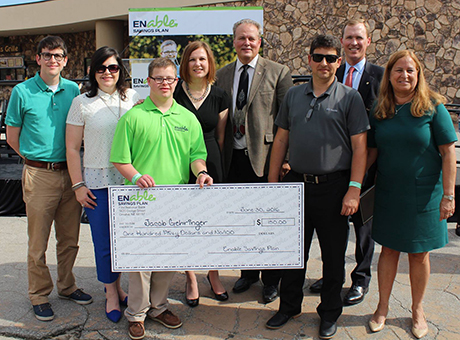

Nebraska was the third state in the nation to set up an ABLE qualified savings plan, on June 30, 2016. The plan is coordinated by First National Bank and is called the Enable Savings Plan. Nebraska’s plan is open to anyone in the nation, not just Nebraska residents. The product brochure gives you a thorough overview of Nebraska’s plan.

Who is eligible?

"An eligible individual is one who:

- is blind or disabled before the age of 26 and is entitled to SSI or SSDI Benefits

or

- has a certification from a physician indicating that he/she has a marked or severe functional limitation that was diagnosed before the age of 26, which is expected to result in death or can be expected to last for a continuous period of not less than 12 months, or is blind.” (Source: ENABLE Website)

What is the difference between SSI (Supplemental Security Income) and SSDI (Social Security Disability Insurance)?

SSI (Supplemental Security Income) program pays benefits to disabled adults and children who have limited income and resources. ($2,000 limit). SSI pays benefits based upon financial need. SSI benefits also are payable to people 65 and older without disabilities who meet the financial limits.

SSDI (Social Security Disability Insurance) pays benefits to you and certain members of your family if you are "insured," meaning that you worked long enough and paid Social Security taxes. Your adult child also may qualify for benefits on your earnings record if he or she has a disability that started before age 22. (Source: SSA web site)

More information can be found on the Social Security website at Benefits for People with Disabilities.

"My child is over 21, and I have lots of questions about how the Enable Savings Plan works with special needs trusts, guardianship, representative payees, SSI/SSDI, etc." The Nebraska Enable Savings Plan answers all of these questions at their Enable U.